All Categories

Featured

Table of Contents

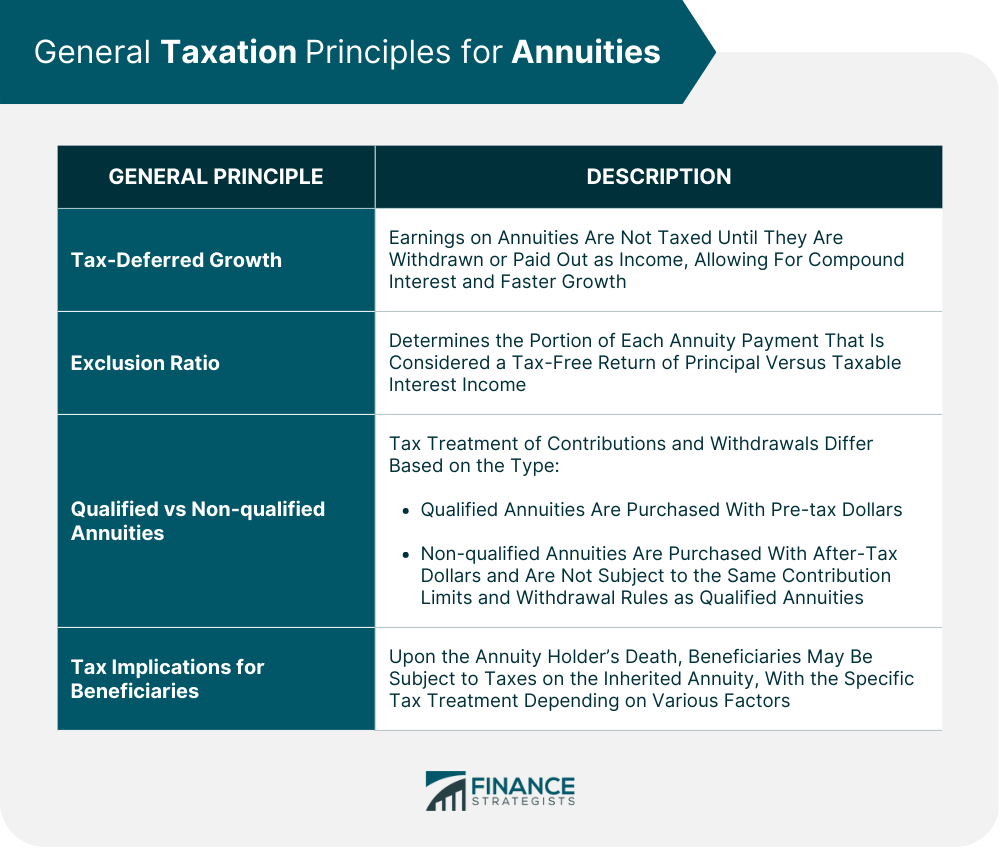

Annuities use tax-deferred development. When you make passion in an annuity, you normally don't need to report those earnings and pay earnings tax on the earnings every year. You can maintain funds in your account to reinvest and intensify. Growth in your annuity is insulated from personal earnings tax obligations. Eventually, you will certainly need to pay earnings tax obligations on withdrawals from an annuity agreement.

While this is a summary of annuity taxation, seek advice from a tax expert prior to you make any type of decisions. Retirement annuities. When you have an annuity, there are a variety of details that can impact the tax of withdrawals and revenue repayments you obtain. If you place pre-tax cash right into an individual retirement account (INDIVIDUAL RETIREMENT ACCOUNT) or 401(k), you pay taxes on withdrawals, and this holds true if you fund an annuity with pre-tax cash

:max_bytes(150000):strip_icc()/do-beneficiaries-pay-taxes-life-insurance.asp-final-7e81561536514dbdb30500ba1918afb3.png)

If you have at the very least $10,000 of profits in your annuity, the entire $10,000 is dealt with as earnings, and would typically be exhausted as regular revenue. After you exhaust the incomes in your account, you receive a tax-free return of your original swelling amount. If you convert your funds into an ensured stream of revenue payments by annuitizing, those settlements are divided right into taxable portions and tax-free sections.

Each repayment returns a part of the money that has currently been strained and a section of interest, which is taxable. For instance, if you get $1,000 monthly, $800 of each payment may be tax-free, while the continuing to be $200 is gross income. Ultimately, if you outlive your statistically identified life expectations, the entire amount of each payment might end up being taxable.

Since the annuity would have been moneyed with after-tax cash, you would certainly not owe taxes on this when taken out. In general, you need to wait until at the very least age 59 1/2 to take out earnings from your account, and your Roth should be open for at least 5 years.

Still, the various other functions of an annuity might outweigh income tax treatment. Annuities can be devices for postponing and handling taxes. Evaluate how finest to structure your retirement, philanthropic offering and other monetary goals with the help of a financial professional and tax obligation expert. A tax-aware method could help you benefit from annuity benefits and prevent shocks in the future.

Are Index-linked Annuities taxable when inherited

If there are any kind of fines for underreporting the income, you could be able to ask for a waiver of penalties, however the rate of interest generally can not be waived. You may be able to prepare a layaway plan with the IRS (Joint and survivor annuities). As Critter-3 stated, a regional specialist may be able to aid with this, but that would likely result in a little bit of additional expenditure

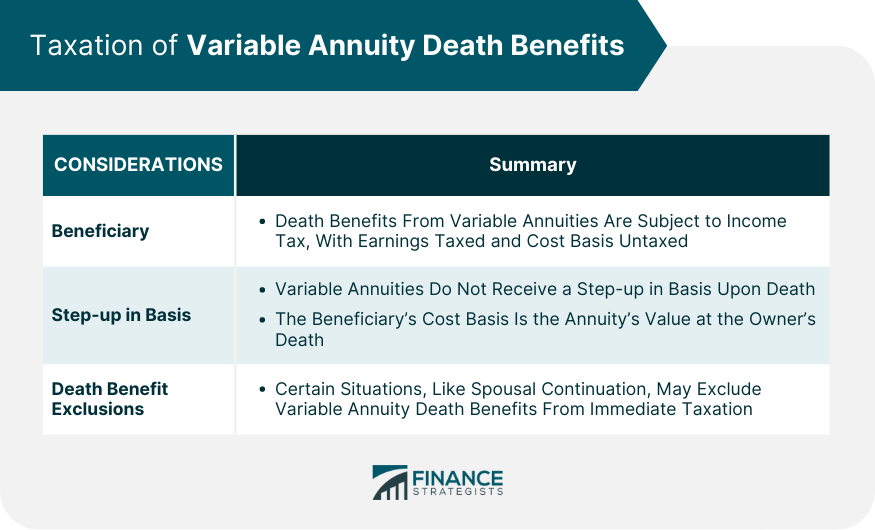

The initial annuity agreement owner need to include a survivor benefit stipulation and call a beneficiary - Annuity cash value. There are different tax obligation effects for spouses vs non-spouse beneficiaries. Any type of recipient can pick to take an one-time lump-sum payment, however, this comes with a hefty tax problem. Annuity beneficiaries are not restricted to individuals.

Fixed-Period Annuity A fixed-period, or period-certain, annuity ensures payments to you for a particular size of time. For instance, repayments may last 10, 15 or twenty years. If you die during this moment, your picked beneficiary obtains any remaining payouts. Life Annuity As the name suggests, a life annuity assurances you repayments for the rest of your life.

Multi-year Guaranteed Annuities inheritance tax rules

If your agreement includes a fatality benefit, continuing to be annuity payments are paid to your recipient in either a round figure or a series of repayments. You can pick someone to obtain all the offered funds or a number of people to receive a portion of staying funds. You can likewise choose a not-for-profit company as your beneficiary, or a trust developed as component of your estate strategy.

Doing so allows you to keep the very same options as the original proprietor, including the annuity's tax-deferred standing. You will likewise have the ability to get remaining funds as a stream of settlements instead of a round figure. Non-spouses can additionally acquire annuity repayments. Nonetheless, they can not transform the regards to the contract and will only have accessibility to the marked funds laid out in the initial annuity contract.

There are 3 major methods beneficiaries can get acquired annuity settlements. Lump-Sum Distribution A lump-sum distribution allows the recipient to get the agreement's whole remaining worth as a solitary repayment. Nonqualified-Stretch Stipulation This annuity contract stipulation enables a beneficiary to obtain payments for the rest of his or her life.

Any beneficiary including spouses can pick to take an one-time swelling sum payment. In this instance, tax obligations are owed on the whole difference between what the initial owner spent for the annuity and the survivor benefit. The round figure is exhausted at average revenue tax obligation prices. Swelling amount payments lug the highest possible tax concern.

Spreading out payments out over a longer period is one method to avoid a huge tax bite. For example, if you make withdrawals over a five-year duration, you will owe tax obligations only on the increased value of the portion that is taken out in that year. It is additionally less likely to push you right into a much greater tax bracket.

Tax on Retirement Annuities death benefits for beneficiaries

This offers the least tax obligation exposure yet also takes the longest time to receive all the cash. Annuity payouts. If you have actually inherited an annuity, you commonly must make a decision concerning your fatality advantage swiftly. Decisions concerning just how you intend to get the cash are usually final and can't be changed later

An acquired annuity is an economic item that permits the beneficiary of an annuity contract to continue getting repayments after the annuitant's fatality. Acquired annuities are commonly made use of to supply income for liked ones after the death of the main income producer in a household. There are 2 kinds of acquired annuities: Immediate acquired annuities start paying out right away.

Taxation of inherited Multi-year Guaranteed Annuities

Deferred acquired annuities permit the beneficiary to wait till a later date to begin obtaining repayments. The finest point to do with an inherited annuity depends on your monetary situation and needs.

It is very important to consult with a monetary consultant before making any type of decisions about an acquired annuity, as they can aid you identify what is ideal for your private conditions. There are a few risks to think about before purchasing an acquired annuity. You ought to know that the government does not ensure inherited annuities like various other retirement products.

Inherited Annuity Interest Rates taxation rules

Second, inherited annuities are often complicated monetary items, making them tough to understand. There is always the threat that the value of the annuity might go down, which would certainly reduce the quantity of cash you obtain in repayments.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works What Is Deferred Annuity Vs Variable Annuity? Features of Smart Investment Choices Why Choosing Be

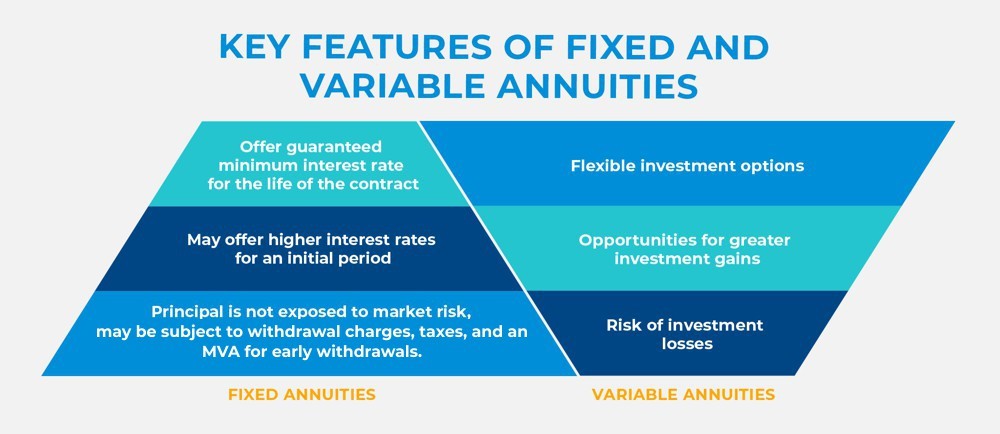

Breaking Down Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices Defining Variable Annuity Vs Fixed Indexed Annuity Pros and Cons of Variable Annuity Vs Fixed Indexed Annuity Why

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Annuity Vs Fixed Annuity Defining Choosing Between Fixed Annuity And Variable Annuity Pros and Cons of Fixed Indexed Ann

More

Latest Posts